FDI Approval Nepal: The Ultimate Guide for Foreign Investors (2025)

FDI approval Nepal is the essential process that foreign investors must navigate to establish business operations in Nepal’s growing economy. This comprehensive guide covers everything you need to know about the foreign direct investment Nepal framework, including the latest 2024 legal updates, step-by-step procedures, and expert strategies for successful investment approval.

What is FDI Approval in Nepal?

FDI approval Nepal refers to the official authorization process required for foreign individuals or entities to invest in Nepali businesses. The Foreign Investment and Technology Transfer Act (FITTA), 2019 governs this process, establishing the legal foundation for foreign direct investment Nepal across various sectors.

Foreign investment in Nepal is defined as:

- Foreign currency investment

- Re-investment of dividends from foreign currency shares

- Lease finance for aircraft, ships, machinery, and equipment

- Investment in venture capital funds

- Investment through purchasing shares or assets of Nepali companies

- Technology transfer investments

Email Us and Get Investment Approval in Nepal

Governing Laws and Legal Framework for FDI in Nepal

The FDI approval Nepal process operates under a comprehensive legal framework that includes:

Primary Legislation:

- Foreign Investment and Technology Transfer Act, 2019 (FITTA) – The foundational law governing FDI Nepal

- Foreign Investment and Technology Transfer Rules, 2021 – Detailed implementation guidelines

- Industrial Enterprises Act, 2020 – Regulations for industrial operations

- Companies Act, 2006 – Company registration and governance

- Foreign Exchange Regulation Act, 1962 – Currency exchange regulations

- Public Private Partnership and Investment Act, 2019 – PPP project frameworks

Recent Legal Updates (2024):

- Ride-sharing restrictions: Foreign ownership limited to 70% in ride-sharing services

- Automatic route introduction: Investments up to NPR 500 million now eligible for automatic approval

- Streamlined procedures: Enhanced One Stop Service Center (OSSC) operations

FDI Approval Authorities in Nepalx

FDI approval Nepal is handled by different authorities based on investment size and sector:

| Investment Amount | Approving Authority |

|---|---|

| Up to NPR 6 billion | Department of Industry (DOI) |

| Above NPR 6 billion | Investment Board Nepal (IBN) |

| Hydropower projects > 200 MW | Investment Board Nepal (IBN) |

| Special Economic Zones | Investment Board Nepal (IBN) |

| Banking & Financial Institutions | Nepal Rastra Bank (NRB) |

| Insurance Companies | Nepal Insurance Authority |

| Telecommunication Services | Nepal Telecommunication Authority |

Sectors Open vs. Restricted for FDI in Nepal

Permitted Sectors for Foreign Investment:

- Hydropower and Renewable Energy (Production and Transmission)

- Infrastructure (Fast Track, Railway, Tunnel, Cable Car, Metro Rail)

- Agriculture and Food Processing (excluding primary production)

- Tourism and Hospitality

- Digital Economy & ICT

- Manufacturing and Industrial Zones

- Health and Education Services

- Mining and Mineral Exploration

- Pharmaceuticals and Biotechnology

Restricted/Prohibited Sectors:

- Primary agriculture (poultry farming, fisheries, bee-keeping, fruits, vegetables)

- Cottage and small industries

- Personal service businesses (hair cutting, tailoring, driving)

- Arms and ammunition manufacturing

- Real estate business (excluding construction)

- Retail business

- Mass communication media (newspaper, radio, television in national language)

- Management consultancy services (over 51% foreign ownership)

- Ride-sharing services (over 70% foreign ownership – 2024 update)

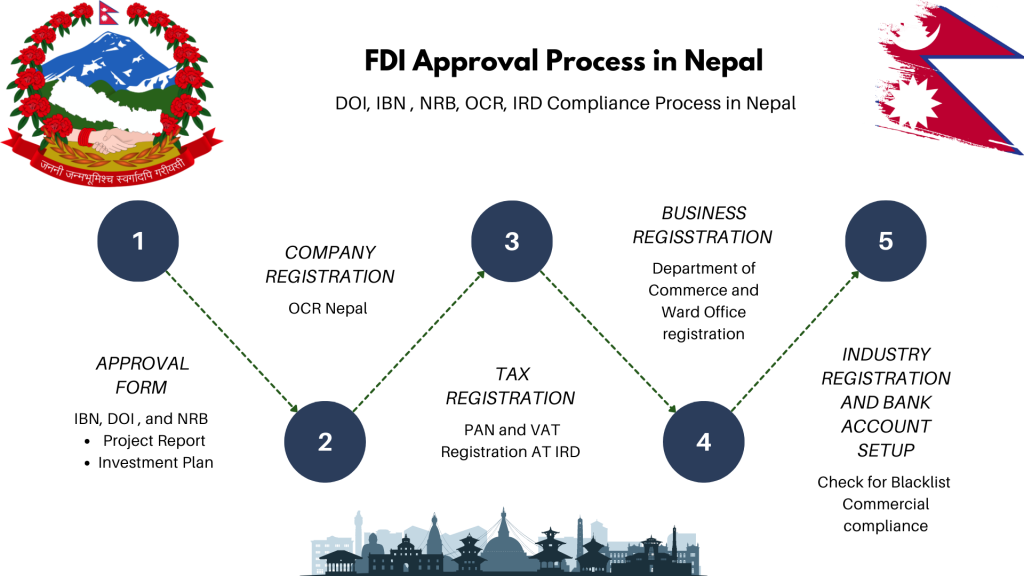

Complete FDI Approval Process in Nepal (Step-by-Step)

Step 1: Foreign Investment Approval (DOI/IBN)

- Submit application to Department of Industry or Investment Board Nepal

- Prepare comprehensive project report and investment plan

- Obtain preliminary approval within 15-30 days

Step 2: Company Incorporation (Office of Company Registrar)

- Reserve company name

- Submit Articles of Association and Memorandum of Association

- Complete company registration process

Step 3: Tax Registration (Inland Revenue Office)

- Obtain Permanent Account Number (PAN)

- Register for Value Added Tax (VAT) if applicable

Step 4: Business Registration (Local Ward Office)

- Register business at local municipal level

- Obtain recommendation letter for industry registration

Step 5: Industry Registration (Department of Industry)

- Complete industry registration formalities

- Submit required documentation and fees

Step 6: Non-Blacklist Certificate (Credit Information Bureau)

- Obtain certificate confirming directors are not financially blacklisted

Step 7: NRB Approval for Investment Infusion

- Get Nepal Rastra Bank approval for foreign currency infusion

- Submit source of funds documentation

Step 8: Investment Infusion and Recording

- Infuse approved investment amount through local bank

- Obtain Investment Certificate from bank

- Record investment with Nepal Rastra Bank

Step 9: Commencement of Operations

- Obtain sector-specific licenses if required

- Begin business operations

Minimum Capital Requirements for FDI in Nepal

| Business Type | Minimum Investment Requirement |

|---|---|

| Manufacturing Industries | NPR 20 million (approx. USD 150,000) |

| Service Industries | NPR 20 million (approx. USD 150,000) |

| Technology-based Industries | NPR 20 million (approx. USD 150,000) |

| IT-Based Industries | No minimum investment required |

| Hydropower Projects | Varies based on project capacity |

Required Documents for FDI Approval in Nepal

Essential Documentation:

- Project Report – Detailed business plan, market analysis, financial projections

- Company Profile – Investor company background and registration documents

- Passport Copies – All directors and shareholders (notarized)

- Board Resolution – Authorizing investment in Nepal

- Financial Credibility Certificate – From investor’s home country bank

- Joint Venture Agreement – If applicable (notarized)

- Power of Attorney – Authorizing local representative

- Investment Schedule – Timeline for capital infusion

- Environmental Impact Assessment – If required for the sector

- Source of Funds Documentation – Proof of legitimate investment funds

Email us at- info@nepallawsunshine.com

Timeline for FDI Approval Process

| Process Stage | Typical Duration |

|---|---|

| Foreign Investment Approval | 15-30 days |

| Company Incorporation | 7-14 days |

| Tax Registration | 3-7 days |

| Business Registration | 5-10 days |

| Industry Registration | 7-14 days |

| NRB Approval | 10-15 days |

| Investment Infusion | 3-5 days |

| Total Process | 2-3 months |

Government Fees for FDI Approval in Nepal

Key Fee Structure:

- DOI Guarantee Deposit: NPR 20,000 (approx. USD 155)

- Company Registration Fee: Varies based on authorized capital (NPR 9,500 – NPR 43,000+)

- Business Registration: NPR 5,000 – 15,000 per year

- House Rent Tax: 10% of monthly rent

Company Registration Fee Scale:

| Authorized Capital (NPR) | Registration Fee (NPR) |

|---|---|

| 500,001 – 25,000,000 | 9,500 |

| 25,000,001 – 100,000,000 | 16,000 |

| 100,000,001 – 200,000,000 | 19,000 |

| 200,000,001 – 300,000,000 | 22,000 |

| 300,000,001 – 400,000,000 | 25,000 |

| 400,000,001 – 500,000,000 | 28,000 |

| 500,000,001 – 600,000,000 | 31,000 |

| 600,000,001 – 700,000,000 | 34,000 |

| 700,000,001 – 800,000,000 | 37,000 |

| 800,000,001 – 900,000,000 | 40,000 |

| 900,000,001 – 10,000,000,000 | 43,000 |

| Above 10,000,000,000 | 30 per lakh |

Foreign Investment Caps by Sector

| Sector | Maximum Foreign Ownership |

|---|---|

| Manufacturing Industries | 100% |

| Service Industries | 100% |

| Banking & Financial Institutions | 20% – 85% |

| Insurance Companies | 80% |

| Telecommunication | 80% |

| Air Transport Services | 49% |

| Domestic Air Transport | 49% |

| Travel Agencies | 67% |

| Trekking Agencies | 51% |

| Consultancy Services | 51% |

| Ride-sharing Services | 70% (2024 update) |

| Retail Business | 51% |

Post-Investment Compliance Requirements

After obtaining FDI approval Nepal, foreign companies must maintain ongoing compliance:

Mandatory Compliance Activities:

- Quarterly Compliance Reports – Submit to Office of Company Registrar

- Annual Compliance Documents – File with OCR

- Investment Recording – Maintain records with Nepal Rastra Bank

- Tax Compliance – Regular filings with Inland Revenue Department

- Labor Law Compliance – Adherence to Labor Act requirements

- Industry-Specific Compliance – Sector-specific regulatory requirements

Repatriation of Profits and Capital:

Foreign investors can repatriate:

- Dividends and profits

- Sale proceeds from share transfers

- Technology transfer fees and royalties

- Capital upon liquidation

- Compensation and indemnity payments

Risk Assessment and Mitigation Strategies

Key Risks in FDI Nepal:

- Regulatory Changes – Frequent policy updates and amendments

- Bureaucratic Delays – Complex approval processes

- Currency Fluctuations – Exchange rate volatility

- Infrastructure Challenges – Limited transportation and utilities

- Political Instability – Government changes affecting policies

Mitigation Strategies:

- Professional Legal Counsel – Engage experienced FDI lawyers in Nepal

- Thorough Due Diligence – Comprehensive market and regulatory research

- Government Relations – Build relationships with key authorities

- Phased Investment Approach – Start with smaller investments

- Local Partnerships – Consider joint ventures with established local companies

FAQ: FDI Approval Nepal

What is the minimum investment requirement for FDI in Nepal?

The minimum foreign direct investment Nepal requirement is NPR 20 million (approx. USD 150,000) for most sectors, except IT-based industries which have no minimum investment requirement.

How long does the FDI approval process take in Nepal?

The complete FDI approval Nepal process typically takes 2-3 months, depending on the complexity of the project and efficiency of document preparation.

Can foreigners own 100% of a company in Nepal?

Yes, foreigners can own 100% of companies in most manufacturing and service sectors, except in restricted areas like banking, insurance, telecommunications, and ride-sharing services where ownership caps apply.

What is the automatic route for FDI approval in Nepal?

The automatic route, introduced in recent reforms, allows investments up to NPR 500 million to receive automatic approval through the Department of Industry’s online system, significantly reducing processing time.

Are there any recent changes to Nepal’s FDI laws?

Yes, in 2024, Nepal introduced restrictions on ride-sharing services (70% foreign ownership cap) and expanded the automatic approval threshold to NPR 500 million, streamlining the investment process.

What documents are required for FDI approval in Nepal?

Essential documents include project reports, company profiles, passport copies, board resolutions, financial credibility certificates, joint venture agreements (if applicable), and source of funds documentation.

Can foreign investors repatriate profits from Nepal?

Yes, foreign investors can repatriate dividends, profits, capital gains, and other legitimate returns subject to Nepal Rastra Bank approval and compliance with tax regulations.

What sectors are prohibited for foreign investment in Nepal?

Prohibited sectors include primary agriculture, cottage industries, personal services, arms manufacturing, real estate (excluding construction), retail business, and mass media in national language.

Is there a faster way to get FDI approval in Nepal?

Yes, investments up to NPR 500 million can use the automatic route through the Department of Industry’s online system, which provides faster approval compared to the traditional process.

What post-approval compliance requirements exist for FDI companies?

FDI companies must submit quarterly compliance reports, annual filings, maintain investment records with Nepal Rastra Bank, comply with tax laws, and adhere to sector-specific regulations.

Government Resources and Contacts

Key Authorities for FDI Nepal:

- Department of Industry (DOI): +977-1-4211505, doind@doind.gov.np

- Investment Board Nepal (IBN): +977-1-4444400, info@ibn.gov.np

- Nepal Rastra Bank (NRB): +977-1-4412771, info@nrb.gov.np

- Office of Company Registrar: +977-1-4432753, ocr@ocr.gov.np

- One Stop Service Center: +977-1-4211505

Useful Online Resources:

- DOI Online Portal: https://imis.doind.gov.np

- Investment Board Nepal: https://ibn.gov.np

- Nepal Rastra Bank: https://www.nrb.org.np

- Company Registrar: https://ocr.gov.np

Conclusion: Your Path to Successful FDI in Nepal

FDI approval Nepal represents a significant opportunity for foreign investors looking to tap into Nepal’s emerging market potential. With the right preparation, professional guidance, and understanding of the regulatory framework, foreign investors can successfully navigate the foreign direct investment Nepal landscape and establish profitable operations.

The 2024 reforms, including the expanded automatic approval route and clearer sectoral guidelines, have made FDI Nepal more accessible than ever before. However, success requires careful planning, thorough due diligence, and ongoing compliance management.

Ready to start your FDI journey in Nepal? Contact our team of experienced FDI lawyers and investment specialists today for personalized guidance through the FDI approval Nepal process. We’ll help you navigate the complexities and maximize your investment success in Nepal’s growing economy.

This comprehensive guide to FDI approval Nepal is regularly updated to reflect the latest legal changes and regulatory requirements. For the most current information and personalized assistance with your foreign direct investment Nepal plans, consult with qualified legal professionals specializing in Nepal’s investment laws.